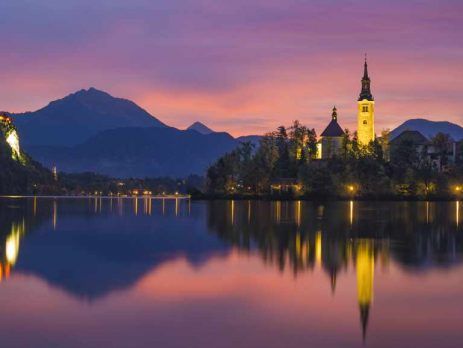

VAT number in Slovenia for doing business in EU

VAT number in Slovenia – taxation The question about how to obtain VAT number in Slovenia is one of the first questions that are get. Before you start a business in Slovenia, it is good to know more about VAT number in Slovenia and system here. The taxation system in Slovenia is quite loyal, especially when compared to neighboring countries. In [...]